Today’s option trading blog concludes my series – How I Trade Options. To date, I’ve found the trade and quantified my opinion. Here’s how the liquidity and implied volatility of the options influences my strategy selection.

One of the advantages of being an individual trader is that I don’t have to worry about “size”. Often, 10 contracts is a large enough position and my order won’t “drive” the market. As a newsletter writer or an institutional trader, I need to make sure the liquidity can support hundreds of contracts. I measure size based on the bid/ask spread and the respective size behind each quote. If I see a $.10 wide spread with 300 contracts on each side for a $4.00 option – I consider it to be liquid. Conversely, if the option market is $.30 wide on a $4.00 option and the size is 20 contracts, the liquidity is poor. There are a number of factors that influence liquidity. The average daily volume of the stock, the number of exchanges that list the options, the expiration month and the strike price.

Active stocks that trade well over a million shares a day are active and have tight bid/ask spreads. That interest spills over to the options. Market Makers/Specialists are able to take the other side of your option trade and they know where they can get their hedge “off”. If you are buying calls, they are selling them to you and they will instantly go out and buy stock against the position. If the stock has a three cent wide bid/ask, they know that they will not have to “reach” for an offer. On the other hand, if the stock trades 300k shares a day and it is a volatile little bio-tech with a $.20 wide bid/ask spread, expect wide ill-liquid option markets.

The more option exchanges that list a stock, the more liquid. By nature, the exchanges don’t want to list every option. The overhead for listing an option might exceed the income they can generate from it. Market Makers don’t want to be spread too thin either. Even though auto-quote programs have made Market Making less labor intensive, they still have costs. There are some stocks that might only support one Market Maker. If an option is multi-listed across more than 3 exchanges, it will be a notch up on the liquidity scale. Each Market Maker on each exchange has to compete to get the order and the best market wins the order. Don’t be afraid to “work” an order from one exchange to another. Even on the same exchange I have entered, cancelled and re-entered an order all in the span of minutes. All things constant, it got filled the second time around because they knew the order was not going to be “dead meat” and that the price was fair. They knew that I was managing the order and there was a chance it would get yanked. If the Market Makers know the order is there to stay, they will lean on it.

In general, the deeper the option (in-the-money and higher dollar value) and the farther out in time, the less liquid. Most people like to trade front month at-the-money options and consequently, that’s where the liquidity is.

If an option is liquid, it will not impact my strategy and I don’t have to modify my game plan. If it’s ill-liquid, I need to look at the duration of the move. For short term moves that may only last a week, I will trade the stock. A $.30 wide bid/ask spread in the options is too big of an “edge” to give up. If the duration of the trade is a month or more and I want to buy options, I will scale into a position with 3-4 months of life. The key is to minimize the transactions and the slippage. I like to go farther out in time because I might have a chance to sell near term out-of-the-money premium against the long “leg” and offset some of the entry/exit slippage. Also, if the position is working out, I don’t have to worry about rolling it as expiration approaches. If the implied volatilities are relatively rich and I’m inclined to sell premium, I will look to sell naked options. If I’m right, they’ll expire worthless and I won’t have to exit the trade. I don’t like to credit spread the position because I don’t want to buy the farther out leg and give up another bid/ask spread and commission. If an option is ill-liquid, the trade carries greater risk and it should be smaller in size.

I could write a 400 page book about trading volatility, but that’s already been done. If you don’t plan on being a Market Maker – keep it simple. I remember listening to two friends and respected option experts each share their views on option trading at a conference. Larry McMillan talked about how options with high implied volatilities were the best ones to buy and Ken Trester stressed never buying an “over-priced” option. In their own context – both were right.

There are many people who will bleed you dry teaching you about delta-gamma neutral trading, back-spreads, ratios, skews…. Focus on the direction of the stock and then consider these simple concepts. There are three things to consider: the historical volatility of the stock, the historical implied volatility of the options and the implied volatility of the options.

If the stock traditionally whips back and forth, it has historical volatility and I can expect the options to carry a relatively high premium. Since it is more difficult to predict, it ‘s only natural for me to distance myself from the day-to-day noise. In these situations, I consider selling out-of-the-money premium. In doing so, I increase the probability of success and I take advantage of time premium decay. In the case of calls, I almost always sell credit spreads since I don’t like the unlimited upside risk. In the case of puts, I normally sell credit spreads. However, if I really like the stock I will sell naked puts with the idea of trying to buy the stock.

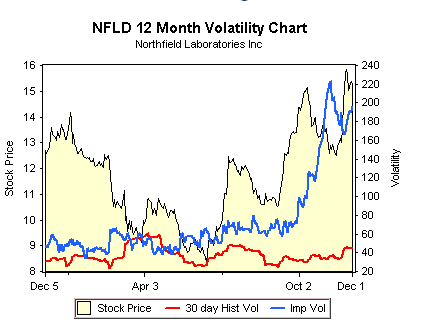

Historical implied volatility and implied volatility can be covered in the same breath. The implied volatility depicts the current expectations for price movement and it is a component of the time premium. Historical implied volatility is where the implied volatility has been in the past. From my standpoint, I want to know that the current implied volatility is within the normal range of where it has been historically. In other words, I want to make sure that there is not an unexplained spike in the premiums. Such an event would tell me that there is uncertainty and that the risk is elevated. If I’m not sure of the reason (earnings, patent, law suit, FDA approval…) the trade should be avoided. If the premium is in range, I should sell it if it is high relative to other stocks and buy it if it’s relatively cheap. optionsXpress has a nice tool that shows all 3 volatilities in a chart format.

The chart below is a current situation. The yellow shows the stock’s price performance, the blue line shows the current and historical implied volatility and the red line shows the historical volatility of the stock. Notice how the implied volatility has spiked to an incredible 200 from it’s normal range of 50! The unassuming novice would run their little implied volatility search program and flag this as a great covered call situation. In two weeks they might be wondering why it went down to $5. This company has been working on a synthetic blood to be used in emergency situations for 15 years. It will release the results of its clinical trials in the next week or two. It could easily go to $0 or $30. Avoid these situations.

In summary, if the options are liquid, sell them if they are relatively expensive and buy them if they are relatively cheap. If they are ill-liquid, try to minimize transactions and go out in time for longer duration trades. For short-term trades, consider trading the stock.

In my next blog, I will try to put it all together in a trade.