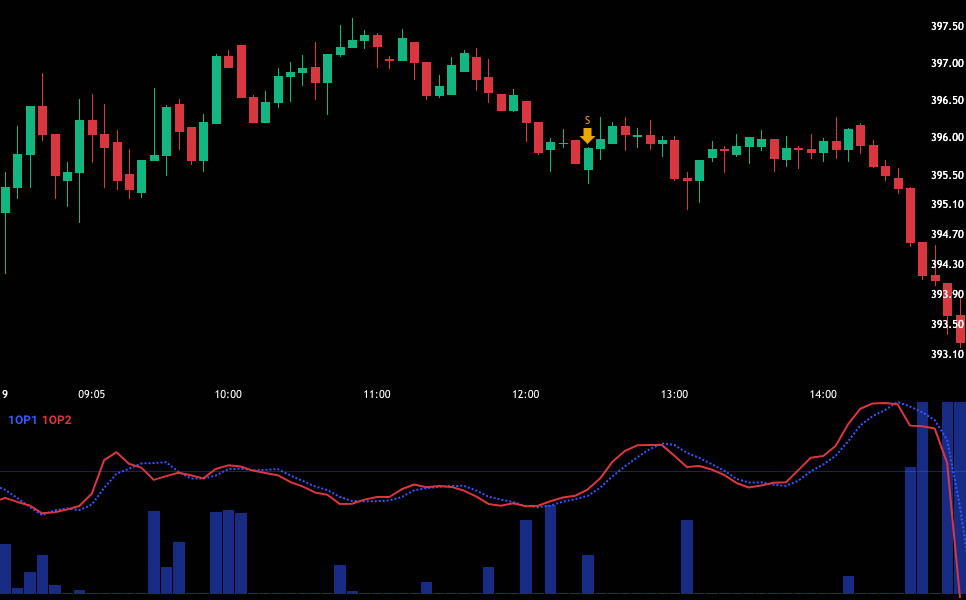

Daily Market Analysis

2022-12-09

Review our intraday commentary to learn how we interpret price action and build a market narrative.

Drag the blue slider to reveal the day's price action. Dots on the timeline represent comments and can be clicked. View the table below for all market-related comments and annotated charts (including those from after hours).

Abbreviated Comments View all

Click to expand content and reposition slider.

| 09:35:12 Pete |

Consumer Sentiment at 10:00 AM ET. I don't plan to trade before then. We have pretty much closed the gap. |

|---|---|

| 09:48:18 Pete |

You should not consider any stocks that do not have heavy volume or that are trapped inside the prior day's range. Those are minimum criteria for a trade today |

| 09:54:04 Pete |

|

| 09:57:43 Pete |

Energy sector is weak and many of those stocks have broken support. |

| 11:12:18 Pete |

Auto wrote: Question Don't worry about answering this questions anytime soon. For those who have been trading decades so Pete and Dave and any others, when is the last time you saw a market so shitty to trade in? I mean... |

Limited Access Only

Become a OneOption member to view all Daily Market Comments. Please visit our Start Here page to learn more about our system and how to become a member via our Free Trial.

Start Free Trial