Volatile Week For the Market – Not Much of a Net Change

Posted 9:30 AM ET - The market remains volatile with big overnight gaps in both directions. This is likely to continue for another day or two and then the action will come to a grinding halt. All eyes will be on the FOMC statement next Wednesday.

The CPI was released Thursday and as expected it was “hot”. Inflation hit 7.9% annual basis (.8% in February vs .7% expected) and that is the highest reading since 1982. This will put upward pressure on interest rates and the Fed could hike 50 basis points next week. The market is starting to get used to the idea of high inflation and the market recovered much of its losses during the day.

Putin said that progress is being made in the negotiations with the Ukraine. No one believes this, but this news is getting credit for the rally this morning. Putin can’t be trusted. I believe that the market is adjusting to the conflict and the shock of war is starting to subside.

Asset Managers are not going to aggressively buy ahead of the FOMC statement. We can expect choppy trading conditions with a downward bias until then.

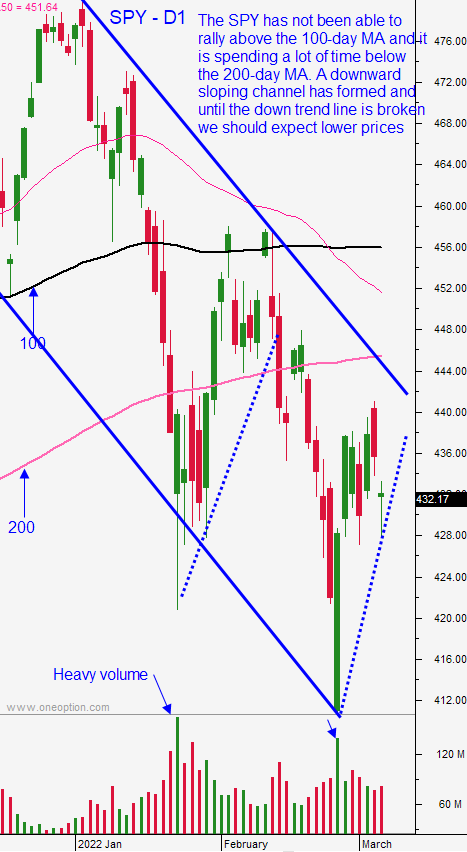

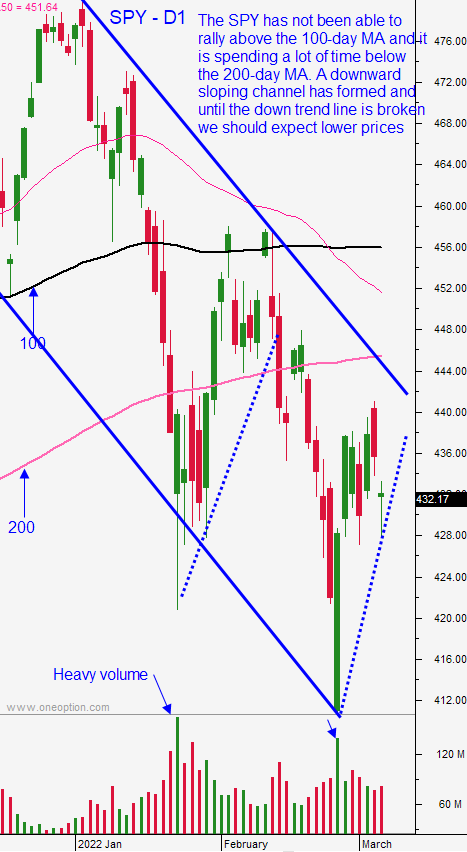

Swing traders should wait for clarity. The downward sloping trading channel on the SPY is still intact and resistance at the 200-day MA will be stiff. That is the upper end of the trading channel and until we break through it we should assume that those bounces are shorting opportunities.

Day traders should expect very choppy trading. The next few days will be position squaring into the FOMC and into quadruple witching. The rally this morning will breach the H1 down trend line. It still has a long way to go to reach the D1 down trend line that comes into play at the 200-day. Gaps up near the low end of the 60-day range can lead to a gap and go. I am not expecting stacked long green candles (10%), but if the opening gap holds we could drift higher like we did Wed (20%). The market found a bid yesterday and most of the loses were erased. The gap up will be tested this morning and I believe we will see a weak drift lower (40%). If the move lower quickly finds support it is a sign that buyers are fairly aggressive and we can expect a fairly bullish day. If the move lower gains momentum and we fill in most of the gap we should expect decent action both ways and a good range.

Support is at $426 and $427.50 and resistance is at $429 and $432.

.

.

Daily Bulletin Continues...