Cash IS King – Keep Swing Trades To A Minimum

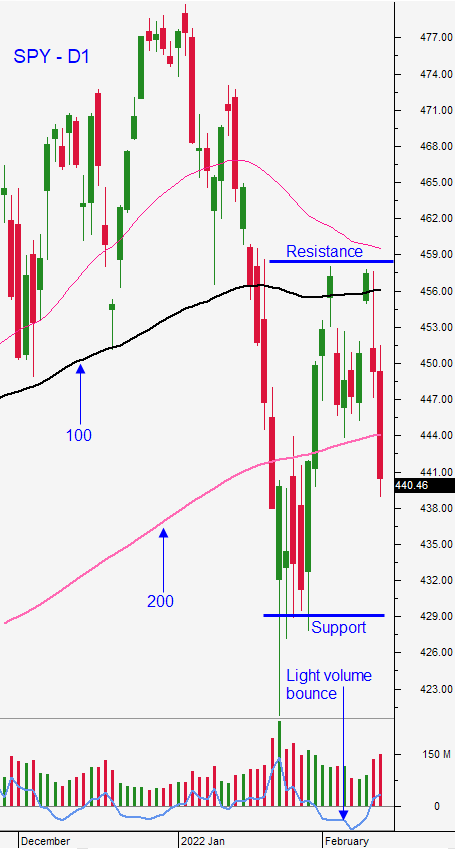

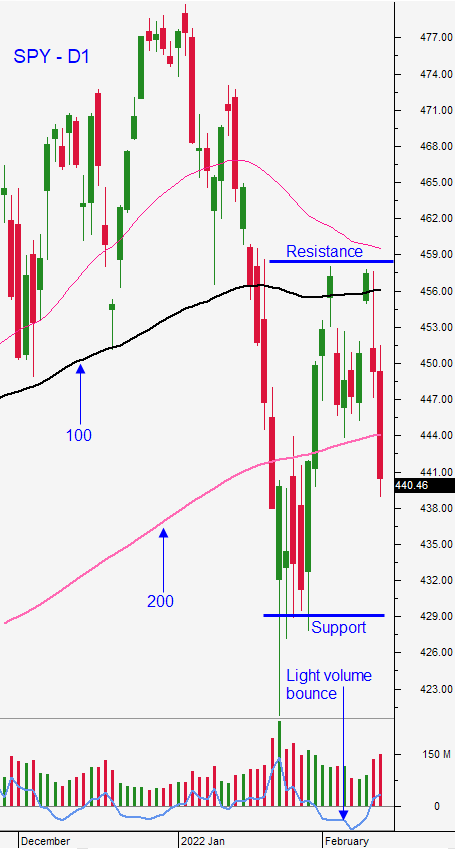

Posted 9:30 AM ET - The market remains focused on Fed tightening and the threat of a Russian invasion of Ukraine. The S&P 500 has been above and below the 200-day MA and that level seems to be a magnet. The S&P 500 fell 35 points overnight when skirmishes on the Ukrainian border were reported.

Wars do not have a permanent impact on the market and I certainly hope that one does not breakout in Europe. We can expect this to weigh on the market for many weeks.

After the FOMC minutes were released yesterday the likelihood of a 50 basis point rate hike in March dropped from 100% to 60%. I don’t put much credence into this reaction because the tone has changed dramatically in just the last two weeks. Those FOMC minutes are a few weeks old and they do not reflect how officials feel now. We know that from recent “Fed speak”. The PPI jumped by 1% this week and the Fed vastly underestimated inflation.

The one tidbit of news that I picked out overnight was that Japan’s exports to China fell for the first time in 19 months. I still believe that economic growth in China is slipping and that credit concerns could start to surface.

Swing traders should be sidelined. We are going to wait for the FOMC in a few weeks and we will watch this chop from the sidelines. With the big overnight gaps even short term swing trading does not make sense.

Day traders should go with the flow. Some days we have nice swings and other days the ranges are very compressed. Watch for consecutive stacked candles with little overlap in either direction. That will be a sign that we will continue to see movement in that direction and that there will be decent activity. If you see mixed green candles with lots of overlap, reduce your trade count and your size.

I don’t have any market feel at this time and that means I have to error on the side of NOT trading. I will try to find a few opportunities during the day, but I am not active in this chop.

Support is at SPY $442 and Resistance is at the 200-day MA.

.

.

Daily Bulletin Continues...