Earnings From Tech Giants and FOMC Statement Today

Posted 9:30 AM ET - Tech giants are reporting earnings and the reaction will tell us if the market has any gas left in the tank. Traders are waiting for the releases and earnings season will climax this week. Traders will watch for hints that the Fed might taper bond purchases this summer when the FOMC statement is release in the afternoon. This is the calm before the storm and trading activity should be brisk Thursday and Friday.

Tesla and Microsoft traded lower after reporting earnings, but AMD and Google are trading higher. The net market impact has been minimal. In general, profits have been very strong. After the close today Apple and Facebook will post results. Amazon will release earnings tomorrow.

In terms of exceeding expectations, this has been one of the strongest quarters in more than a decade. On average 84% of the companies have beat profit expectations and 77% have beat revenue growth projections. Valuations are still fairly rich and fantastic news is priced in.

This afternoon the Fed will discuss current economic activity levels and they will outline their plan. States are open for business and this recovery is just getting started. I don't believe that the Fed will hint at tightening today. If they mention reducing asset purchases the market will have a negative reaction. I am not expecting anything new at this meeting and consequently I am not expecting much of a market reaction.

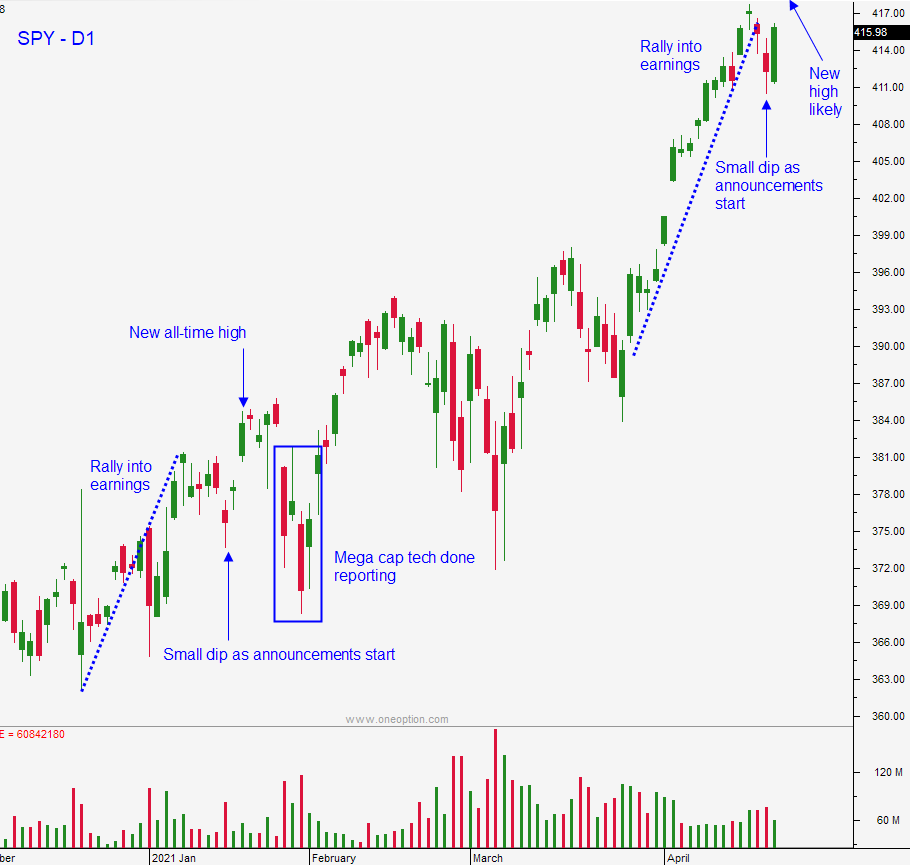

Swing traders should remain sidelined. The market has made a big 8% run in the last month and we've seen profit-taking when the SPY reaches the upper end of the trading channel this year. Mega cap tech earnings keep buyers engaged before the announcements and we often see a letdown after the actual releases. As the excitement wanes, sellers become more aggressive. I'm not looking for a big market drop, but I do believe that we will have a dip in the next two weeks. That retracement will help us identify relative strength and we will be selling out of the money bullish put spreads once support is established. Don't chase this rally. I'm expecting the SPY to reach $420 this week and it will be hard to resist temptation. It's important to note that my swing trading comments are designed for traders who hold positions for 3 to 4 weeks. If you are a longer term swing trader – stay long and know that you will hit a speedbump soon.

Day traders should use Option Stalker searches to find relative strength/relative weakness and heavy volume. There have been opportunities on both sides of the market and this is likely to be a choppy day. Trading volume will decline after two hours of trading and we will be "dead till the Fed". Keep your size small and your trade count low after the first two hours. After the FOMC statement the action will pick up. Monetary policy and big earnings releases will provide us with lots of action Thursday and Friday.

Support is at $414 and $416. Resistance is at $418 and $420.

.

.

Daily Bulletin Continues...