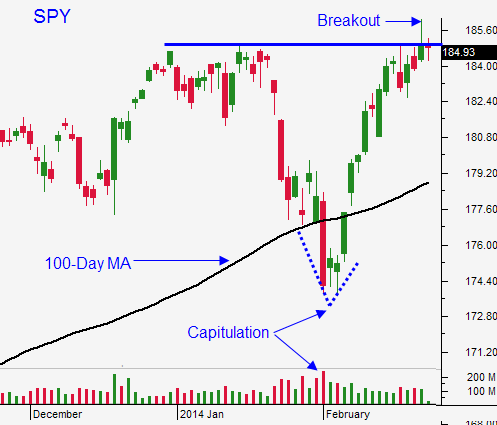

Failed Breakout. Bullish Speculators Will Get Flushed Out – We Will Close On the Low Today

Last week, the market broke through resistance and it made a new all-time high. The move was tenuous and it lacked “punch”. Friday started off strong and we saw a late day reversal. That selling pressure has spilled over this morning.

Janet Yellen testified before Congress last Thursday. Her statements instilled confidence, but the message was not market friendly. She said that a substantial decline in economic activity would be needed to move the Fed off of its tapering program. Her message was consistent with the FOMC minutes.

The rally last week could have lacked conviction because of Russian troop movements. The province of Crimea is currently under Russian military control and this could be the start of a new Cold War. Outside of economic sanctions, it does not appear that the US or the EU will help the Ukraine.

Asset Managers do not want to chase stocks at an all-time high. The news is getting "heavy" and they will pull bids. Bullish speculators piled into the market when it broke out and they are about to get flushed out.

GDP came in at 2.4% last week and durable goods orders were weaker than expected. Initial jobless claims inched higher and that does not bode well for the employment releases (ADP and the Unemployment Report) this week.

ISM manufacturing came in better-than-expected this morning. However, official PMI's were mixed. China was weaker than expected and Europe was slightly better than expected.

To this point, traders have given sluggish economic releases a free pass due to bad weather. That might be getting a little old and temperatures have not eased. We also know that the Fed needs a substantial decline before they postpone tapering.

I am not bearish; I just feel that stocks are due for a small pullback. That dip will set up a good buying opportunity.

I exited my call positions this morning and I made a little money because I scaled in at good levels during the last 2 weeks.

I got short this morning and I believe the market will drift lower this afternoon. I believe bullish speculators will get flushed out and we will close on the low of the day. I will trim my short position before the bell because I do not want to carry a large overnight put position. I can get short again tomorrow.

The price action should be weak through Friday. Support at SPY $182 (50-day MA) will get tested.

If you are a swing trader, go to cash. If you are nimble, get short and maintain tight stops. Know that you are on the wrong side of a five-year uptrend and keep your size small.

The better move will come on the rebound. As long as economic activity is decent, the dip should be brief and relatively shallow.

.

.

Daily Bulletin Continues...